Total crypto VC funding hit $8 billion in Q3 2025, powered not by hype but by policy stability. The Trump administration’s pro-crypto stance and tokenization’s rise turned regulation from a headwind into alpha.

For investors, the shift signals predictable frameworks, institutional exits, and a market no longer ruled by speculation — a structural reset that makes compliance a source of performance.

Sponsored

Why Policy Became the Catalyst

Why Important

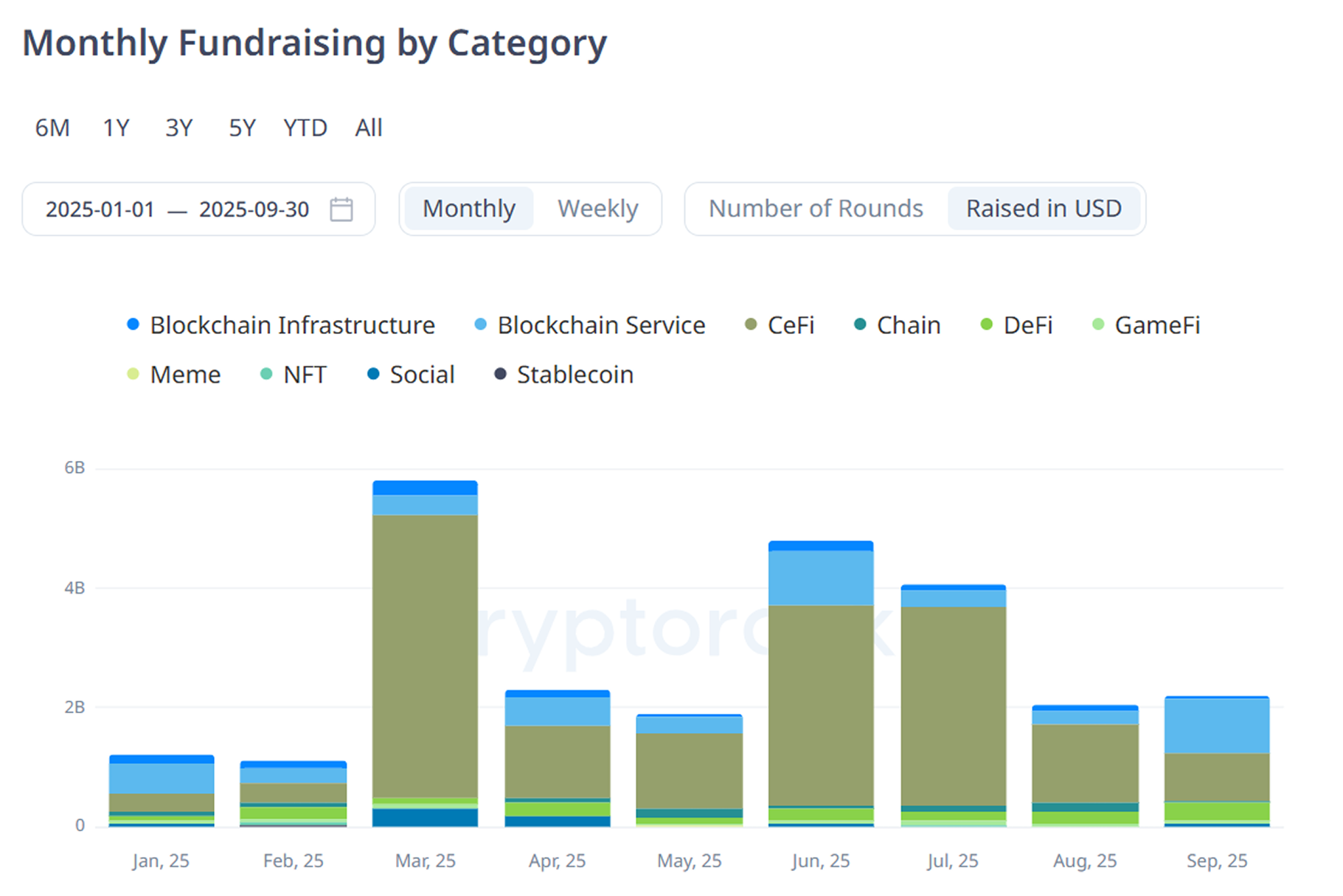

CryptoRank data show US-based funds drove one-third of crypto VC activity in Q3. Federal clarity on stablecoins, taxation, and compliance drew institutions back, producing the strongest quarter since 2021. The figures confirm that US regulation—rather than liquidity—now shapes venture momentum.

Crypto VC Confidence Returns

Latest Update

The Silicon Valley Venture Capitalist Confidence Index posted one of its steepest drops in two decades, before rebounding in Q2 as tariff anxiety eased. Capital rotated into tokenization, compliance, and AI–crypto convergence — seen as resilient amid uncertainty. The rebound suggests investors are recalibrating, not retreating, trading hype for fundamentals as policy replaces sentiment as the main compass for risk.

State Street found that 60% of institutions plan to double their digital-asset exposure within three years, with over half expecting 10–24% of portfolios to be tokenized by 2030. Tokenized private equity and debt are becoming the “first stop” for liquidity-seeking allocators, though LP-token models remain legally gray. Tokenization institutionalizes the venture itself, turning private markets into programmable, tradable capital.

Behind the Scenes

Llobet noted that funds like a16z, Paradigm, and Pantera now use tokenized side vehicles, letting LPs trade fund shares on compliant platforms. DAO treasuries and decentralized pools are emerging as rivals to traditional VC funding, showing how crypto now finances itself through its own rails.

Sponsored

Background

Regulatory opacity once kept allocators away. “Legal uncertainty and illiquidity constrained blockchain finance,” as noted by Llobet’s 2025 study. That changed when Washington approved a national stablecoin framework and tax incentives for compliant entities, legitimizing crypto for pensions and sovereign funds.

Global Repercussions

Wider Impact

CryptoRank’s Q3 data show 275 deals, two-thirds under $10M — clear evidence of discipline over speculation.

CeFi and infrastructure absorbed 60% of capital, while GameFi and NFTs fell below 10%. Investors are re-rating risk through cash flow rather than hype — a hallmark of market maturity.

Sponsored

| Metric | Q3 2025 | Source |

|---|---|---|

| Total VC Funding | $8B | CryptoRank |

| Avg Deal Size | $3–10M | CryptoRank |

| Institutional Allocation | +60% planned increase | State Street |

| Confidence Index | 3.26 / 5 | SSRN / SVVCCI |

State Street expects tokenized funds to be standard by 2030, while CryptoRank projects $18–25B in 2025 inflows — a sustainable, compliance-driven cycle. Regulation now functions less as a constraint than as a competitive edge.

Crypto VC Faces Its First Real Stress Test

Risks & Challenges

Ray Dalio warned that US debt, now about 116% of GDP, mirrors pre–World War II dynamics and could erode risk appetite if fiscal repair stalls.

Sponsored

Dalio’s “deficit bomb” and SVVCCI data suggest trade volatility could delay IPOs. Ackerman of DataTribe warned AI euphoria may form a “bubble” that resets valuations and diverts capital from Web3. Policy may anchor sentiment, but macro debt and AI speculation will test whether the sector’s new discipline can hold.

“Institutional investors are moving beyond experimentation; digital assets are now a strategic lever for growth,” said Joerg Ambrosius, State Street.

“Trade volatility will limit exits short term, but AI and blockchain remain the twin pillars of new value creation,” noted Howard Lee, Founders Equity Partners.

“Crypto VC has institutionalized. Tokenized funds are the new standard for liquidity,” said Marçal Llobet, University of Barcelona.

Crypto VC has entered a disciplined, institutional phase. Regulatory clarity and tokenization are expanding access while reducing volatility. Yet continued growth depends on macro stability and measured risk-taking. If predictability holds, 2025 may be remembered as the year compliance became alpha.