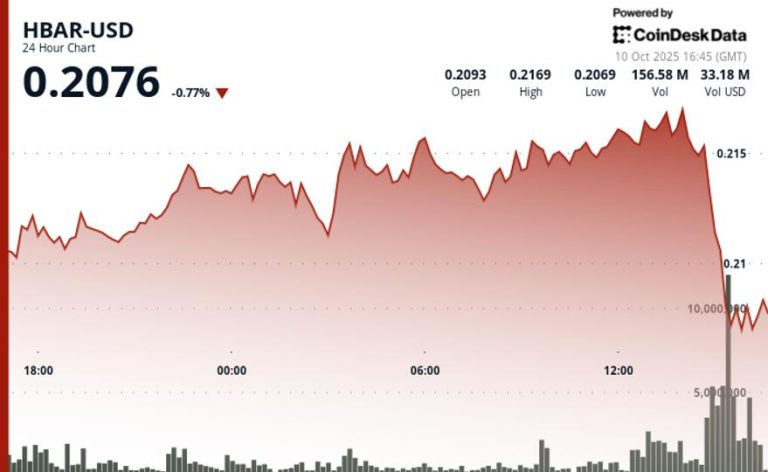

Hedera Hashgraph’s HBAR token came under heavy institutional selling pressure over the 24-hour trading period ending October 10, with prices fluctuating within a volatile 6% range between $0.21 and $0.22. Despite early resilience that saw HBAR climb toward intraday highs near $0.22, the digital asset reversed sharply in the final trading hour, as institutional investors initiated broad-based selloffs that erased earlier gains.

Trading data pointed to exceptional activity during this selloff, with volumes surging to 262.49 million—nearly six times higher than the session’s 47.32 million average. Analysts identified the 3:00 PM hour on October 10 as the inflection point, where the heaviest liquidation occurred. The abrupt spike in volume and price pressure suggested coordinated selling by institutional players, possibly as part of broader portfolio rebalancing.

Technically, HBAR broke through multiple short-term support levels during this final hour, with price action stabilizing only as trading activity ceased in the closing minutes. The sharp drop and subsequent lull may reflect temporary liquidity constraints or trading desk closures as institutions moved to limit exposure ahead of potential regulatory updates.

Technical Analysis for Corporate Investors

- Key resistance levels formed around $0.22-$0.22 where institutional buying interest repeatedly failed to materialize at higher price levels.

- Corporate support emerged around the $0.21-$0.21 range before being decisively broken during the final hour’s institutional selling wave.

- The most significant institutional liquidation occurred during the 3:30-3:35 PM window, where corporate trading volume spiked to over 12.80 million and 16.90 million respectively.

- Price action declined from $0.21 to a session low of $0.21, before corporate buyers attempted a modest recovery to $0.21 by 3:44 PM.

- Institutional trading activity ceased entirely during the final four minutes (3:56-3:59 PM), suggesting corporate trading desk closures or temporary liquidity constraints ahead of regulatory developments.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.