The Bitcoin Policy Institute’s executive director, Matthew Pines, says the Trump administration’s silence on a Strategic Bitcoin Reserve (SBR) is calculated, not complacent. In a new interview with Natalie Brunell, he argues Washington is deliberately studying how to graft Bitcoin—“digital gold”—onto the dollar system while geopolitical and financial conditions ripen. “Chekhov’s gun has been put on the table and we’re in Act One,” he said, implying the policy will remain quiet until events force a decision.

Pines frames the aim bluntly: counter China’s gold accumulation by elevating Bitcoin inside the US reserve mix. “A clever counter move would be pivoting to digital gold while China anchors on legacy gold,” he said, noting Bitcoin is roughly “10 percent of gold’s market cap.” He believes a 10x–20x path to parity within about five years is plausible if policy catalyzes adoption.

Why The Quiet On Bitcoin?

Interagency alignment has not yet crystallized. Pines says the Treasury, the White House, the Pentagon, the intelligence community, and key Hill committees must agree before an SBR can move. Until then, the priority is a market-structure package CLARITY, which he still sees as “more likely than not” to pass, though timing has slid into winter. He wants the Blockchain Regulatory Certainty Act folded in to protect open-source developers from money-transmitter rules. “If market structure gets passed, then more political attention can be brought to bear on the Strategic Bitcoin Reserve,” he said.

On acquisition mechanics, Pines points to a “budget-neutral” route via the Exchange Stabilization Fund—created by the Gold Reserve Act—as legally plausible but dependent on Treasury issuing supportive opinions. “You have to structure the transaction in the right way to acquire Bitcoin,” he said. For now, officials are in “study” mode rather than execution.

Stablecoins are the bridge in this strategy, not the destination. Pines describes their rise as a market phenomenon later harnessed by policymakers: with issuer reserves held in short-term Treasuries, stablecoins become a structural buyer of US debt while deepening global dollar usage. The sector is too small today to shoulder that role, he said, but could scale into the trillions under an on-shore regime—buying time to modernize the reserve mix with Bitcoin.

Personnel signals point to a national-security lens. Pines highlights Patrick Witt’s move to lead the President’s Working Group on Digital Assets after serving at the Pentagon’s Office of Strategic Capital, which has authority to deploy large sums into critical technologies. He expects less public signaling and more behind-the-scenes planning: “I’m not expecting massive acquisitions… imminently. But the Overton window has now dramatically shifted.”

Fantastic conversation with Matthew Pines. We cover:

– Global currency chess

– What to expect from D.C. on Bitcoin

– China’s embrace of gold settlement for trade

– Are we in a simulation?Timecodes:

00:00 U.S. Government & Bitcoin Update

8:49 Game Theory and Stablecoins

12:50… pic.twitter.com/SdIYCYP1PJ— Natalie Brunell ⚡️ (@natbrunell) October 7, 2025

Notably, speculation around US intent continues. In an October 8 post on X, CleanSpark’s Matthew Schultz said he discussed the Market Structure bill and the SBR with senior officials.

Via X, he revealed, “Just finished a small dinner with Secretary Bessent and Chairman Scott. We talked about the Market Structure bill. We talked about the economy. We talked about the 11 finalists for the Chair of the Fed, and we talked about the Strategic Bitcoin Reserve. The US holds about $17B of Bitcoin and ‘will not sell’ and plans to continue to accumulate. […] no other ‘crypto’ or AI folks were here.”

Just finished a small dinner with Secretary Bessent and Chairman Scott. We talked about the Market Structure bill. We talked about the economy. We talked about the 11 finalists for the Chair of the Fed, and we talked about the Strategic Bitcoin Reserve.

The US holds about…

— S Matthew Schultz (@smatthewschultz) October 8, 2025

Meanwhile, US Senator Lummis confirmed the ongoing effort for a SBR earlier this week. “Legislating is a slog and we continue to work toward passage. But, thanks to President Trump, the acquisition of funds for an SBR can start anytime,” Lummis posted on X.

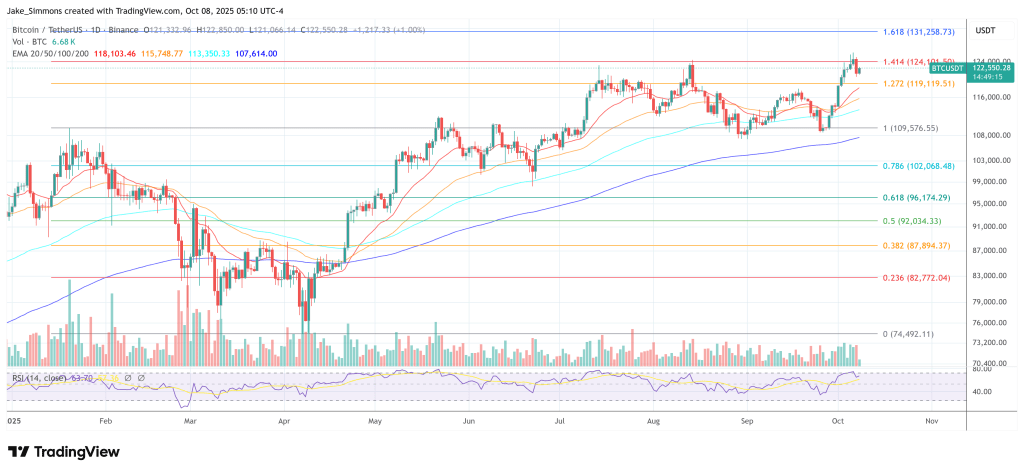

At press time, BTC traded at $122,550.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.